Frequent Client Question: How to Evaluate the Stock Options as Part of a Compensation Package?

Read MoreINSIGHTS

We share expert insights on executive compensation, retirement plans, fiduciary duties, and more.

Stay updated on the latest legal trends and practical advice for employers and executives.

The IRS has provided some short term relief from some of the requirements.

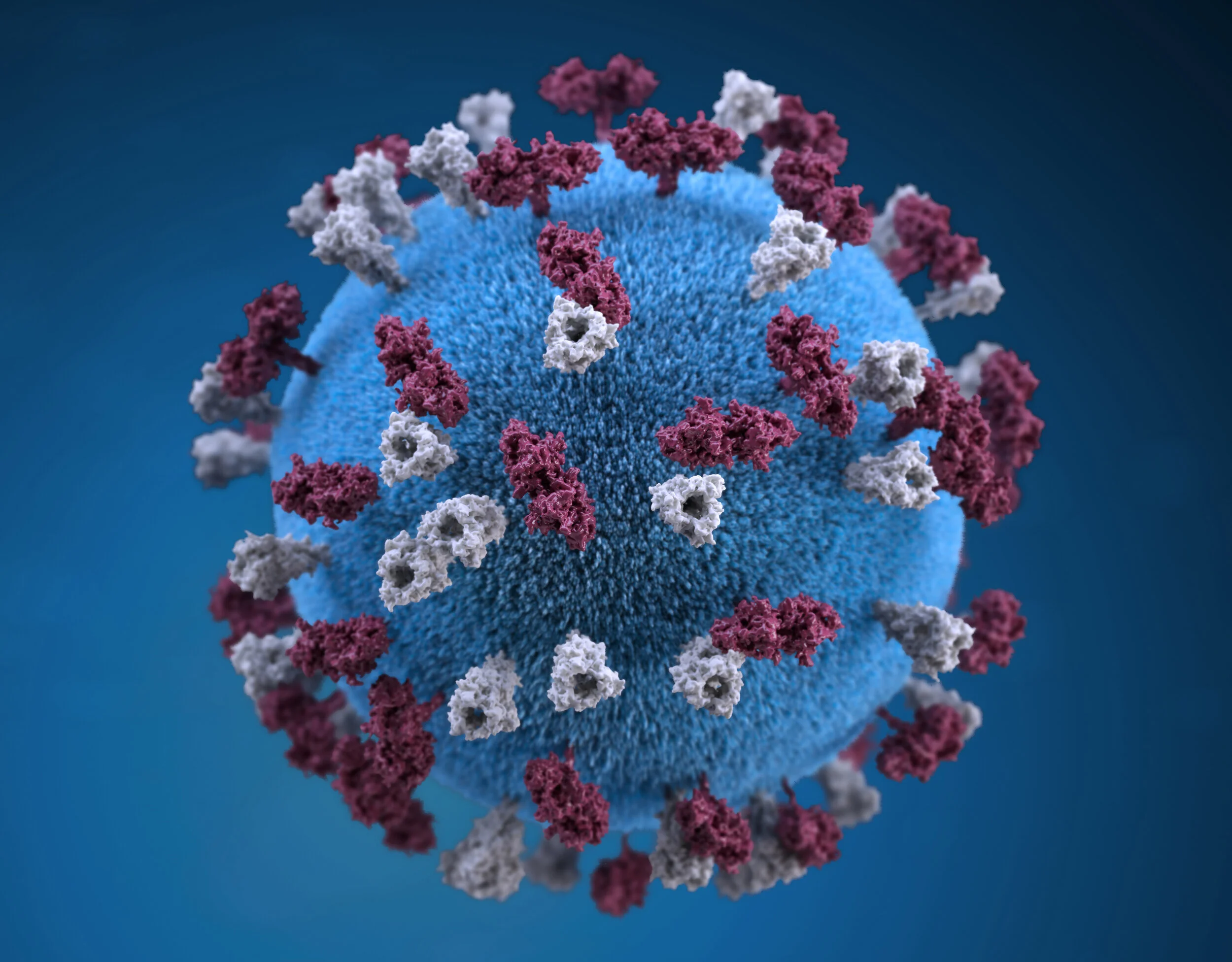

Read MoreEmployee Benefits COVID-19 Digest: Here’s our first compilation of our weekly columns from Plan Sponsor magazine.

Read MoreThe IRS has explained how plan sponsors and participants can handle the waiver of 2020 required minimum distributions.

Read MoreIrene Bassock weighs in on Harvard Business Review article on ways to create a supportive workplace environment for all individuals, especially those at high risk of getting ill from COVID-,19 as they return to work.

Read MoreIRS guidance in Notice 2020-50 expands the scope of CARES Act relief.

Read MoreThe coronavirus has prevented participants from getting spousal consents they need to get distributions and loans. IRS has provided temporary relief.

Read MoreWhen to deposit employment taxes for RSUs? The IRS issued a generic legal advice memorandum (GLAM) addressing employment tax timing that includes a key point related to RSUs and determining the right date.

Read MoreCarol Buckmann weighs in on SCOTUS decision in Thole v. U.S. Bank.

Read MoreWhat are the implications for future lawsuits?

Read MoreCarol Buckmann quoted in Law360 article about new ERISA lawsuits that could clarify plans' cybersecurity duties,

Read MoreElizabeth Drigotas shares additional, more detailed resources to help businesses reopen safely during and after the COVID-19 pandemic.

Read MoreCarol Buckmann authors COVID-19 Compliance Corner, a weekly column in PLANSPONSOR magazine.

Read MoreCarol Buckmann quoted in Forbes article.

Read MoreExecutive compensation attorney Elizabeth Drigotas joins Cohen & Buckmann.

Read More