RMDs generally were established to ensure that individuals begin withdrawing funds from their retirement plans, like 401(k)s, and IRAs, at a specific age. This policy helps the government collect taxes on these savings, which were initially tax-deferred. With people living longer, the age for RMDs was recently pushed back, giving your savings more time to grow before you dip in.

Read MoreINSIGHTS

We share expert insights on executive compensation, retirement plans, fiduciary duties, and more.

Stay updated on the latest legal trends and practical advice for employers and executives.

What does a retirement plan self-audit have in common with routine auto maintenance? You really should not put it off until later! There is a big financial benefit to employers who find and fix their plan problems before the IRS and DOL do!

Read MoreThe webinar will discuss state retirement savings plan mandates, employer-sponsored plan options that can provide larger benefits than state programs, and tax incentives available to small businesses adopting new plans.

Read MoreTwo recently introduced bills would restrict or discourage classes of retirement plan investments. Is this the right policy?

Read MoreSECURE 2.0 contains big changes to the required minimum distribution rules, including changes that could encourage annuitization of 401(k) plan benefits. Here are the important takeaways.

Read MoreSeveral provisions of SECURE 2.0 ease penalties for IRA violations and provide new options for employers sponsoring SIMPLE-IRAs and SEPs.

Read MoreIndividual states are stepping up to provide a vehicle for those not covered by employer-sponsored retirement plans to save for retirement. However, employers who would be covered by these programs may not be aware of alternative options that can accept higher contributions. This article discusses the issues.

Read MoreNew Auto-IRA Requirement for N.Y.S. Employers

Read MoreCarl Buckmann will be speaking at a PLANSPONSOR webinar on distribution options for employees on August 20, 2020.

Read MoreThe IRS has explained how plan sponsors and participants can handle the waiver of 2020 required minimum distributions.

Read MoreCarol Buckmann quoted in Law360 article about new ERISA lawsuits that could clarify plans' cybersecurity duties,

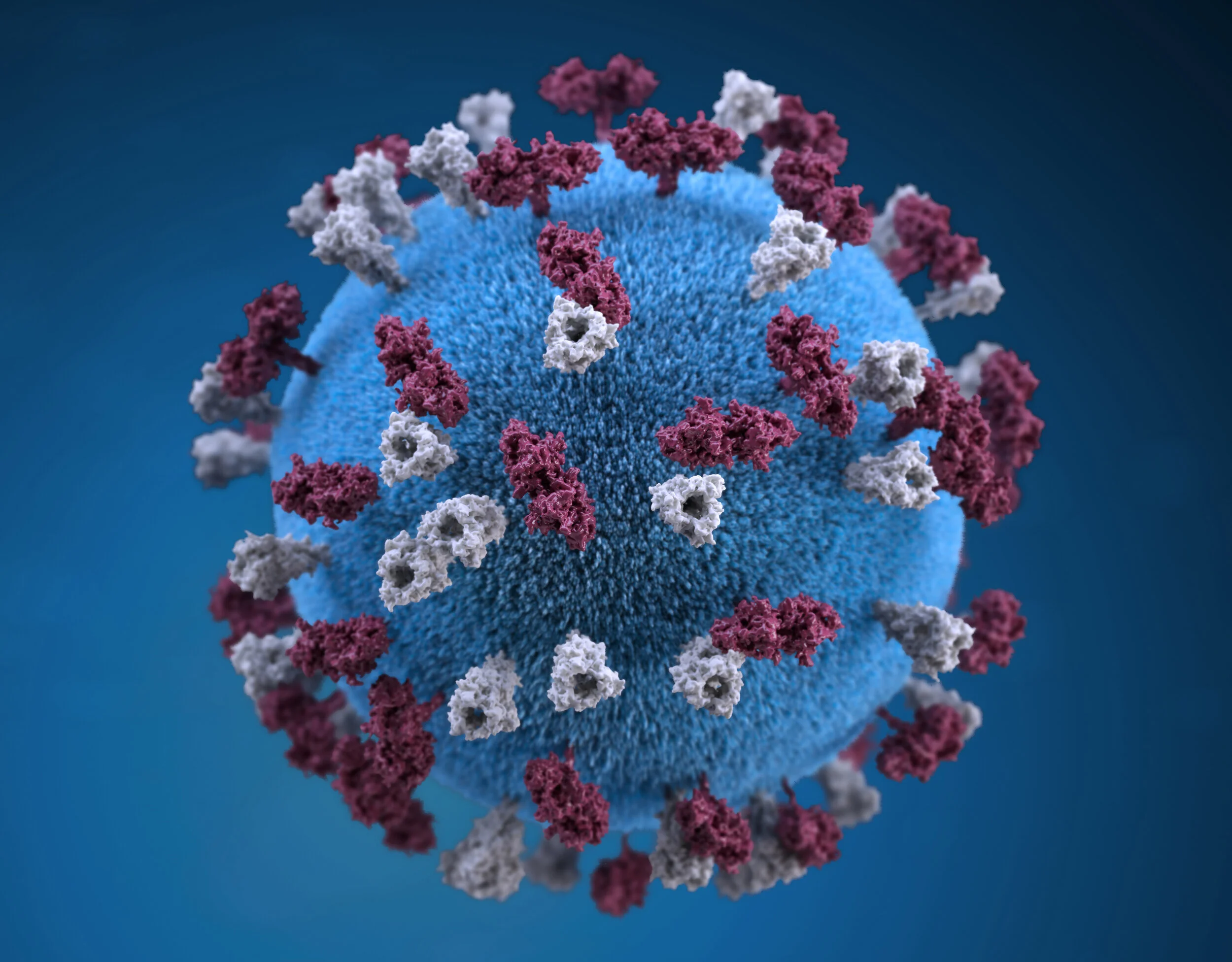

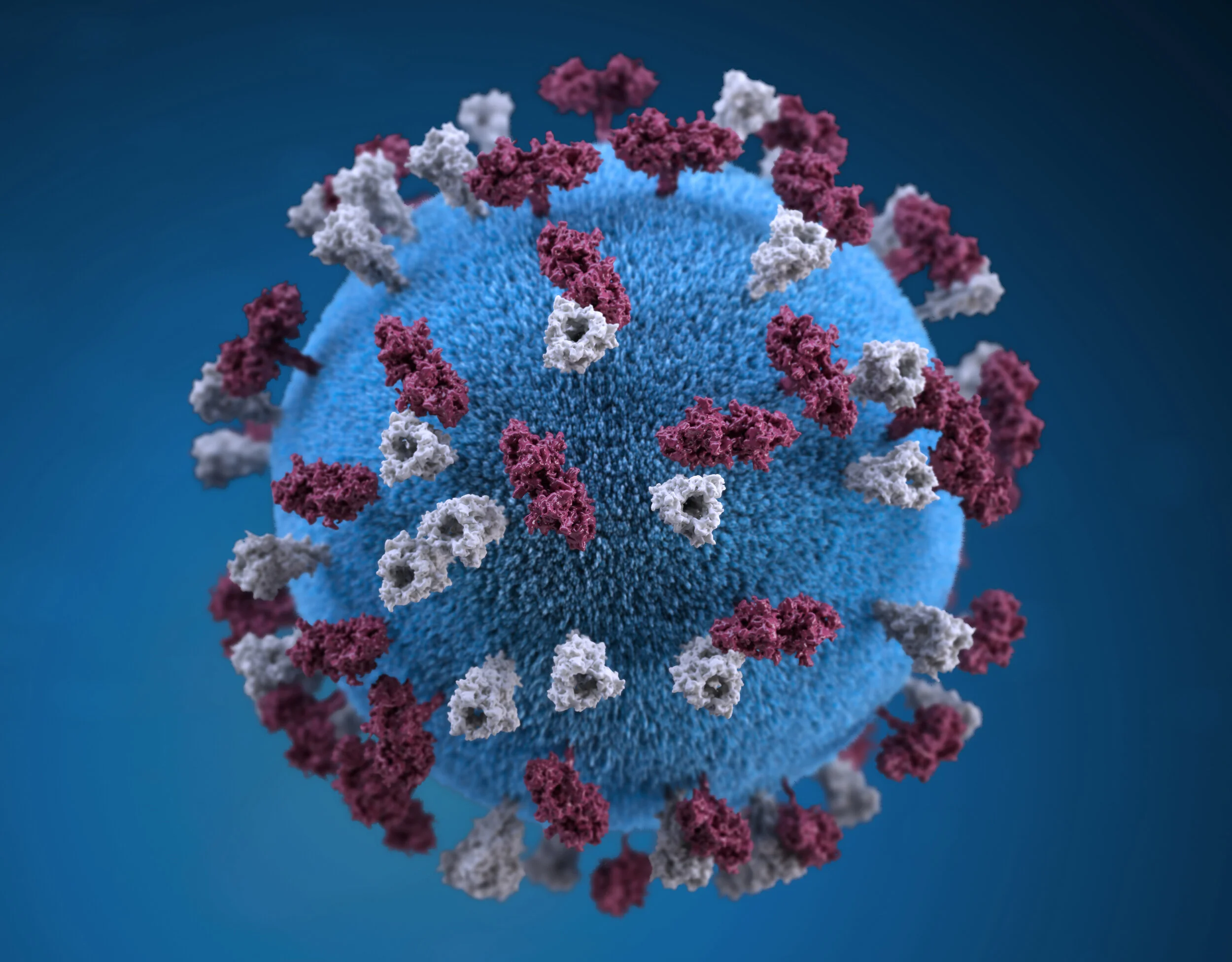

Read MoreCarol Buckmann authors COVID-19 Compliance Corner, a weekly column in PLANSPONSOR magazine.

Read MoreBenefitsPro magazine quotes Carol Buckmann in article about employer contributions to 401(k) plans.

Read MoreCarol Buckmann quoted in SHRM article about the newly passed CARES Act.

Read MoreThe CARES Act provides assistance to plan sponsors, participants and IRA owners adversely affected by COVID-19.

Read More