Why 401(k) fiduciaries need a process for selecting and reviewing target date funds.

Read MoreINSIGHTS

We share expert insights on executive compensation, retirement plans, fiduciary duties, and more.

Stay updated on the latest legal trends and practical advice for employers and executives.

BenefitsPro magazine quotes Carol Buckmann in article about employer contributions to 401(k) plans.

Read MoreCarol Buckmann quoted in SHRM article about the newly passed CARES Act.

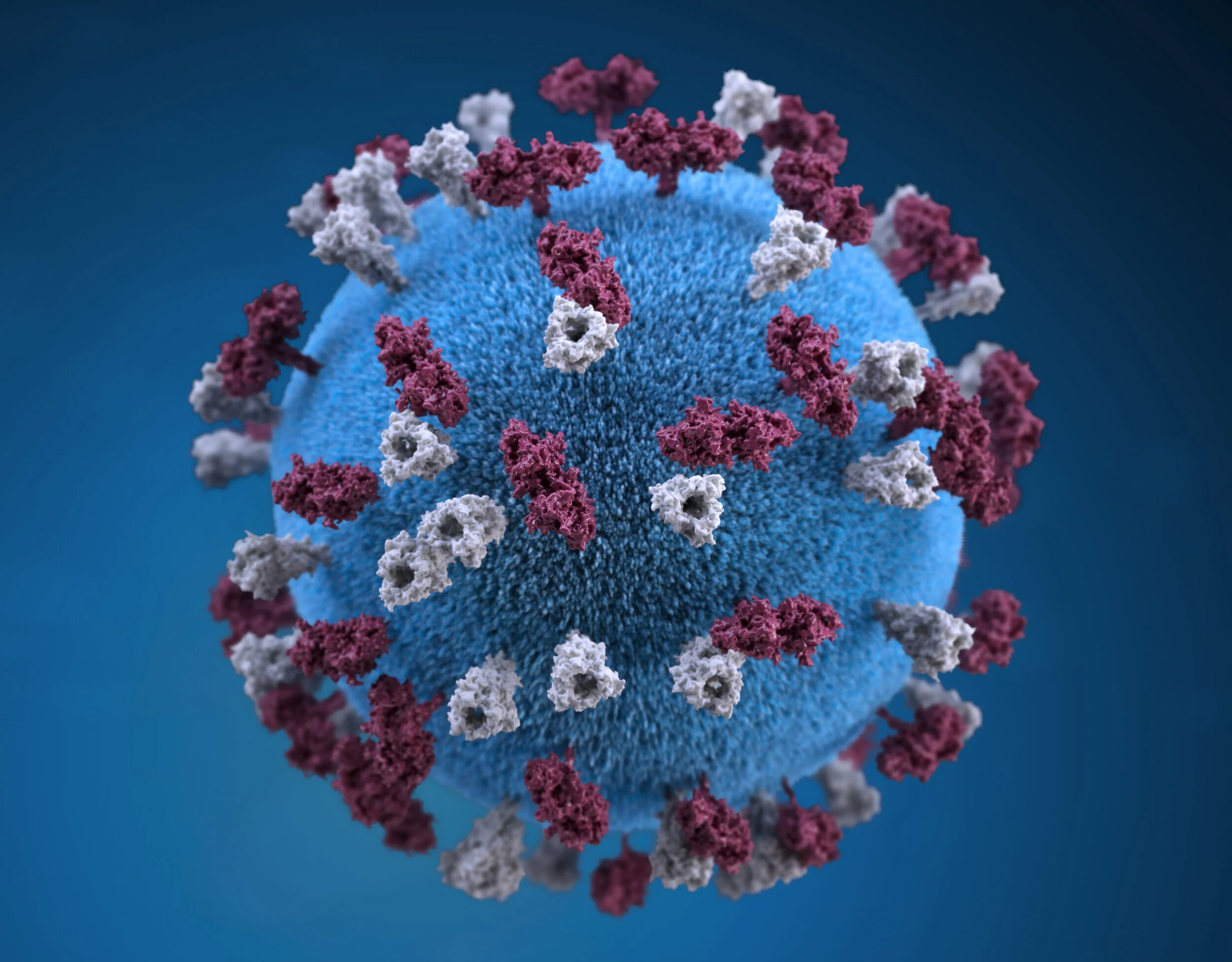

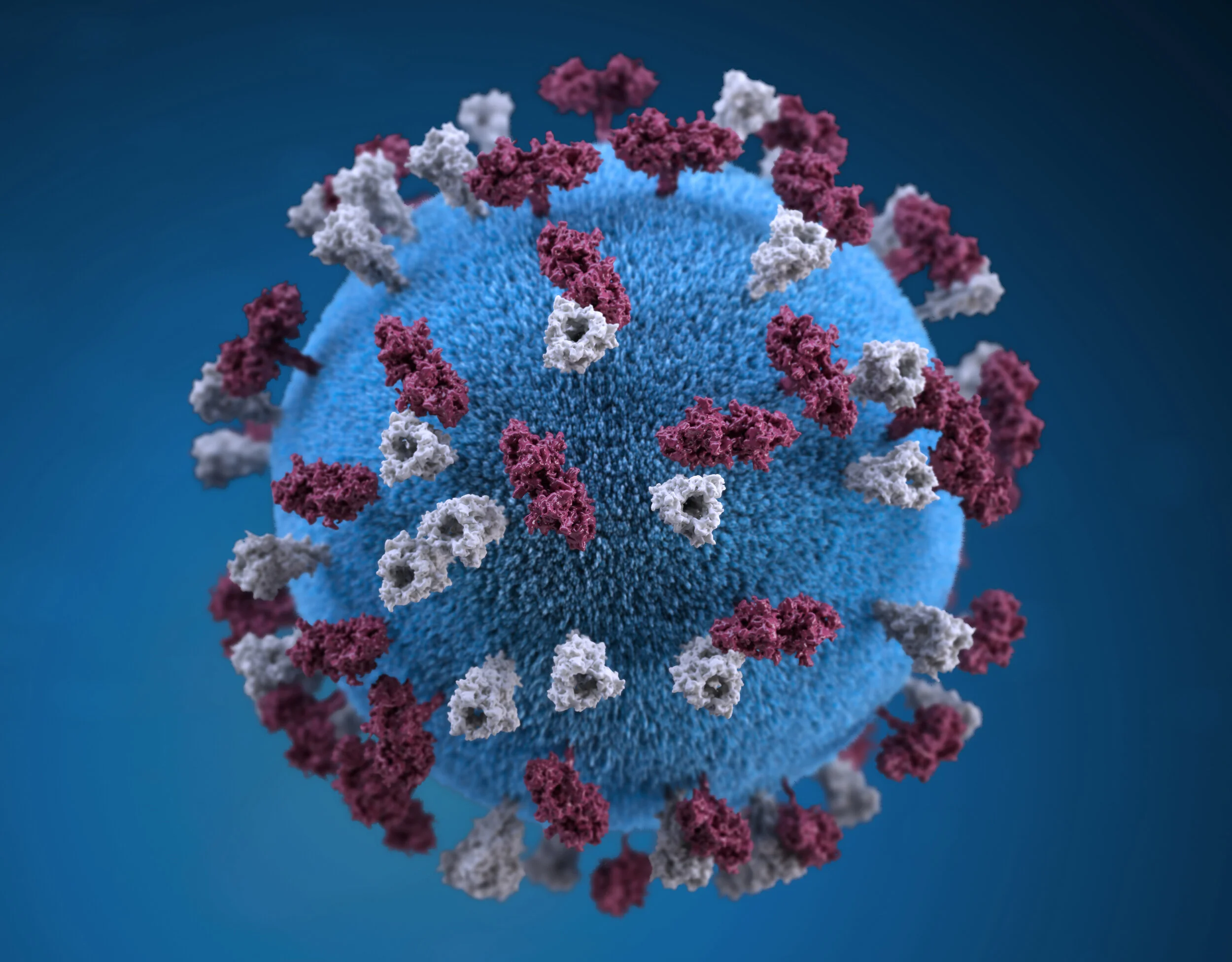

Read MoreThe CARES Act provides assistance to plan sponsors, participants and IRA owners adversely affected by COVID-19.

Read MoreEmployer Options to Suspend or Reduce Employer 401(k) Contributions

Read MoreCarol Buckmann talks about litigation surrounding target-date funds in the latest issue of Plan Sponsor magazine.

Read MoreNew IRA Rules May Change Your Estate Plan.

Read MoreCarol Buckmann’s “Ask the Lawyer” column explores whether using retirement plan participant data to cross-sell products violates ERISA.

Read MoreCan plan fiduciaries prove that participants read the required disclosures about investments? The Supreme Court weighed in on the issue of “actual knowledge” of a plan participant.

Read MoreCarol Buckmann publishes an article about the SECURE Act on the PenChecks blog.

Read MoreEmily Meyer joins Cohen & Buckmann.

Read MorePooled Employer Plans, or PEPs. are poised to become an attractive way for small employers to maintain 401(k) plans.

Read MoreNew SECURE Act distribution rules require changes in plan administration. Sponsors and service providers need to be ready to implement them.

Read More401kTV published an article that discusses the recent Cohen & Buckmann Insights blog that analyzes the SECURE Act, the most comprehensive pension reform since 2006.

Read MoreYou can take advantage of many SECURE Act benefits in 2020. This post highlights some new rules for 401(k) plans.

Read More